It's the People's Money

Paying taxes is how we build a strong foundation where everyone—from Menomonie to Milwaukee—can thrive. But, for decades the wealthy few have rigged our tax code so they pay less than their fair share. Then, they work to pit our families against each other based on our zip code, so they can hoard the wealth our work creates. As a result of these intentional policy choices and unjust structure, Wisconsin’s racial and economic disparities are some of the worst in the country.

Previously known as the Wisconsin Budget Project, we’re working to ensure every family has the opportunity to thrive, especially those most impacted by disinvestment, and not just the powerful few.

Reclaim. Rebuild.

Reimagine.

Join us to unrig the rules that benefit the wealthy few. View our full policy agenda.

Research & Publications

Proposed Tax Cut Privileges Wealthiest 1%, Leaves Struggling Families Behind

June 29, 2023 Wisconsin can be a place where we all—regardless of race or place—have what we need to make ends meet. However, last week the Republican-controlled Joint Finance Committee voted for a tax cut that would aid in gutting supports for families. Letting...

Health Access in the Fox Valley

Every child and family in the Fox Valley and across Wisconsin deserves to live happy healthy lives with affordable, quality health care, regardless of race, income, or zip code.However, many residents of the Fox Valley area face barriers to receiving health care,...

K-12 Education in the Fox Valley

Every student in the Fox Valley region deserves to receive the educational support and resources needed to help them achieve a bright future. Over the past few years, the COVID-19 pandemic has led to significant impacts on students in Wisconsin. These challenges were...

Early Care & Education in the Fox Valley

Every child deserves a solid foundation in life, regardless of income. Affordable and accessible early care and education ensures that parents can get to work and sets children up for a strong start. The COVID-19 pandemic highlighted how child care is critical for...

This Tax Day, Wisconsin Families Pay More in Taxes for Every Dollar they Earn than the Wealthiest 1%

FOR IMMEDIATE RELEASEFor Release: April 18, 2023Contact: Emily Miota, emiota@kidsforward.org This Tax Day, as many Wisconsin families struggle to make ends meet, the wealthiest Wisconsinites are allowed to pay a smaller share of their income to taxes than low and...

The State Budget is an Opportunity to Reduce Income Inequality

April 14, 2023 Whether Black, Brown, or white, rural or city, we all can thrive when state leaders invest in our children, families, and communities. The 2023-25 state budget provides an opportunity to leverage the state’s strong fiscal position to create a solid...

Restoring Driver Licenses to all Wisconsinites

Restoring access to driver licenses for every eligible Wisconsinite will keep families together, increase economic opportunities for working families, ensure safer roads, and boost state revenue. For decades, driver licenses had been available to immigrant drivers up...

The 2023-25 State Budget Should Support Wisconsin Families Who Are Struggling to Get By

From Racine to Rice Lake, Wisconsinites work hard to provide for their families. In the wake of the pandemic, the rising cost of goods and services has made it difficult for many to make ends meet. And for too long, certain politicians have created barriers and made...

Wisconsin’s Strong Fiscal Position is an Opportunity to Ensure Everyone Benefits

April 11, 2023 Wisconsin can be a place where we all—regardless of race or place—have what we need to overcome challenges and make our families safe and well. The state’s historically large surplus is an opportunity to build a stronger foundation for children and...

Analyzing the State Budget

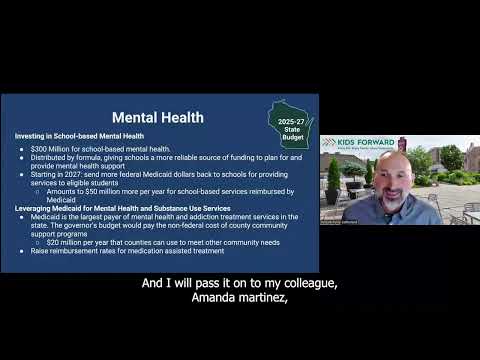

At Kids Forward, we know that a budget is more than just numbers; it’s a statement of values. It shows who and what Wisconsin cares about. The Wisconsin state budget—negotiated every other year in odd years—is how we invest in the public infrastructure and supports that our families and communities need. Too often, powerful, wealthy individuals and corporations influence our legislators to cut taxes instead of funding public schools, child care, and making health care more affordable. As a result, every day families struggle to make ends meet, services are harder to access, and the richest few continue to reap the benefits.

We dig through the state budget to provide community partners and advocates with the resources and tools they need to ensure the results of people’s hard work make it back to their communities. View our analyses and resources further below.

Fighting for an Equitable Tax and Revenue System

Families across Wisconsin are struggling to get by, and it shouldn’t be a surprise. Economic inequality has exploded over the past 40 years. In the last four decades, the wealthiest 20% of Wisconsinites have seen dramatic growth in their incomes, while everyone else has seen no increase or watched their income decline.

Kids Forward advocates for a fair and equitable tax system that benefits all. If the most wealthy few paid their fair share, Wisconsin could invest in critical services such as child care, health care, and a fair wage for all workers. We provide decision makers and community partners with the tools they need to advocate for a fairer tax system.

Share your Story

How would tax reform and an equitable budget benefit your family or community?

Join our mailing list below to receive powerful analysis and ways to get involved sent straight to your inbox.

Sign up for Emails

Your address helps us identify your legislators and the most relevant messages to send you.